401k Matching Limits 2025. This amount is up modestly from 2025, when the individual 401. For 2025, it is going to be the same at $7,500.

Simple retirement plan contribution limits increased to $16,000 in 2025 (up from $15,500 in 2025). Contribution limits for a roth 401(k) are the same as a traditional 401(k).

Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50.

401k Annual Limit 2025 Reeva Celestyn, Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50. The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

What Are the Maximum 401(k) Contribution Limits? GOBankingRates, Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50. No employer matching or nonelective contributions are permitted.

Va Limits 2025 Bari Mariel, The 2025 limit on 401 (k) contributions is $23,000, or $30,500 for people 50 and older. The 401(k) contribution limit for individuals has been.

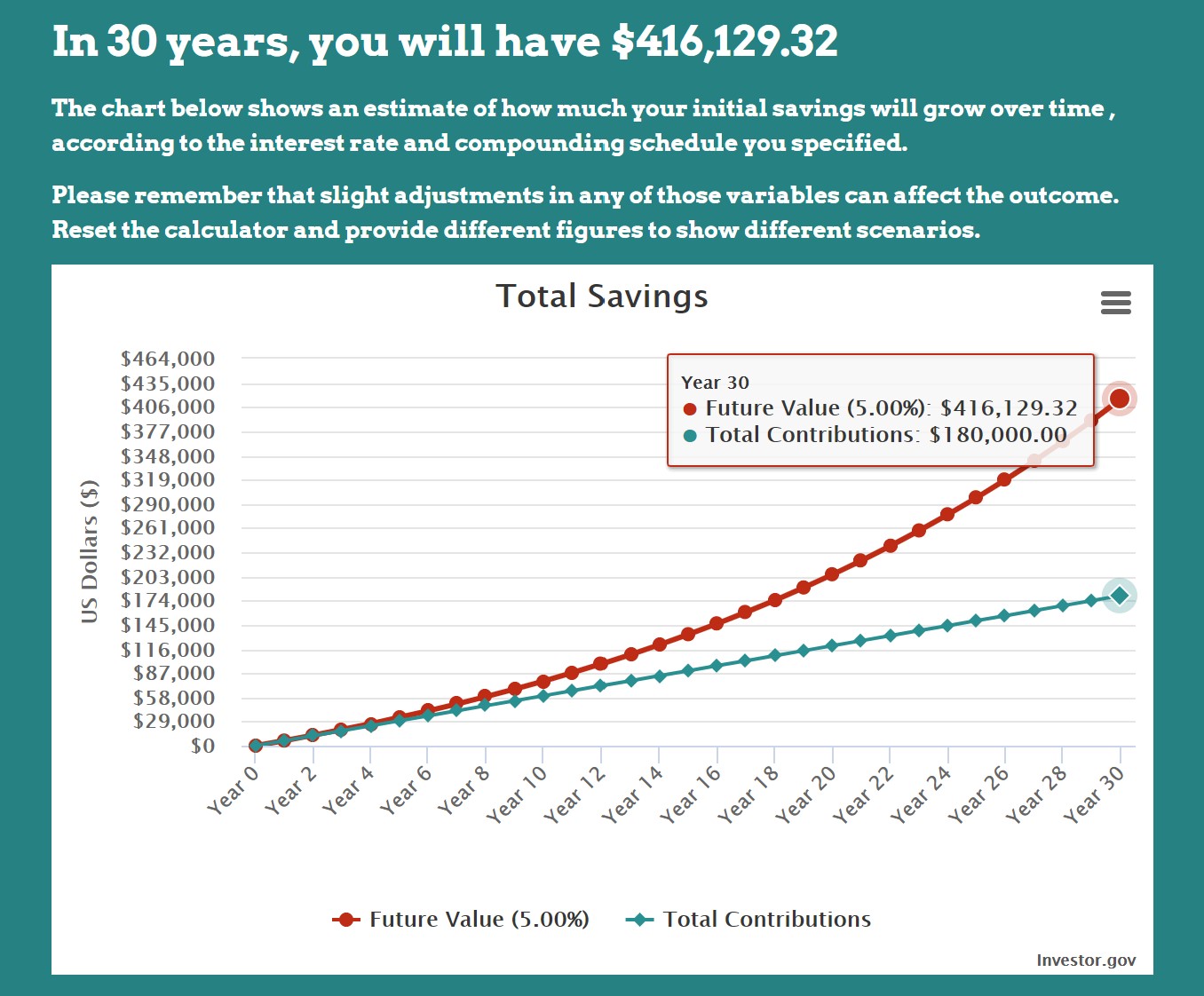

401k Changes For 2025 Dodi Nadeen, Nerdwallet’s free 401(k) retirement calculator calculates your 2025 contribution limit and employer match, then estimates what your 401(k) balance will be at retirement. For 2025, it is going to be the same at $7,500.

Free 401(k) Calculator Google Sheets and Excel Template, For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025. But if you max out your 401 (k).

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Treidaus 2025 Sivu 318 Kauppalehden keskustelupalsta, They sport hefty contribution limits. The 2025 limit on 401 (k) contributions is $23,000, or $30,500 for people 50 and older.

The IRS just announced the 2025 401(k) and IRA contribution limits, Solo 401(k) roth 401(k) limits; The contribution limit on 401(k) plans in 2025 is $23,000, with workers 50 and older allowed to set aside an additional $7,500 to catch up on retirement planning.

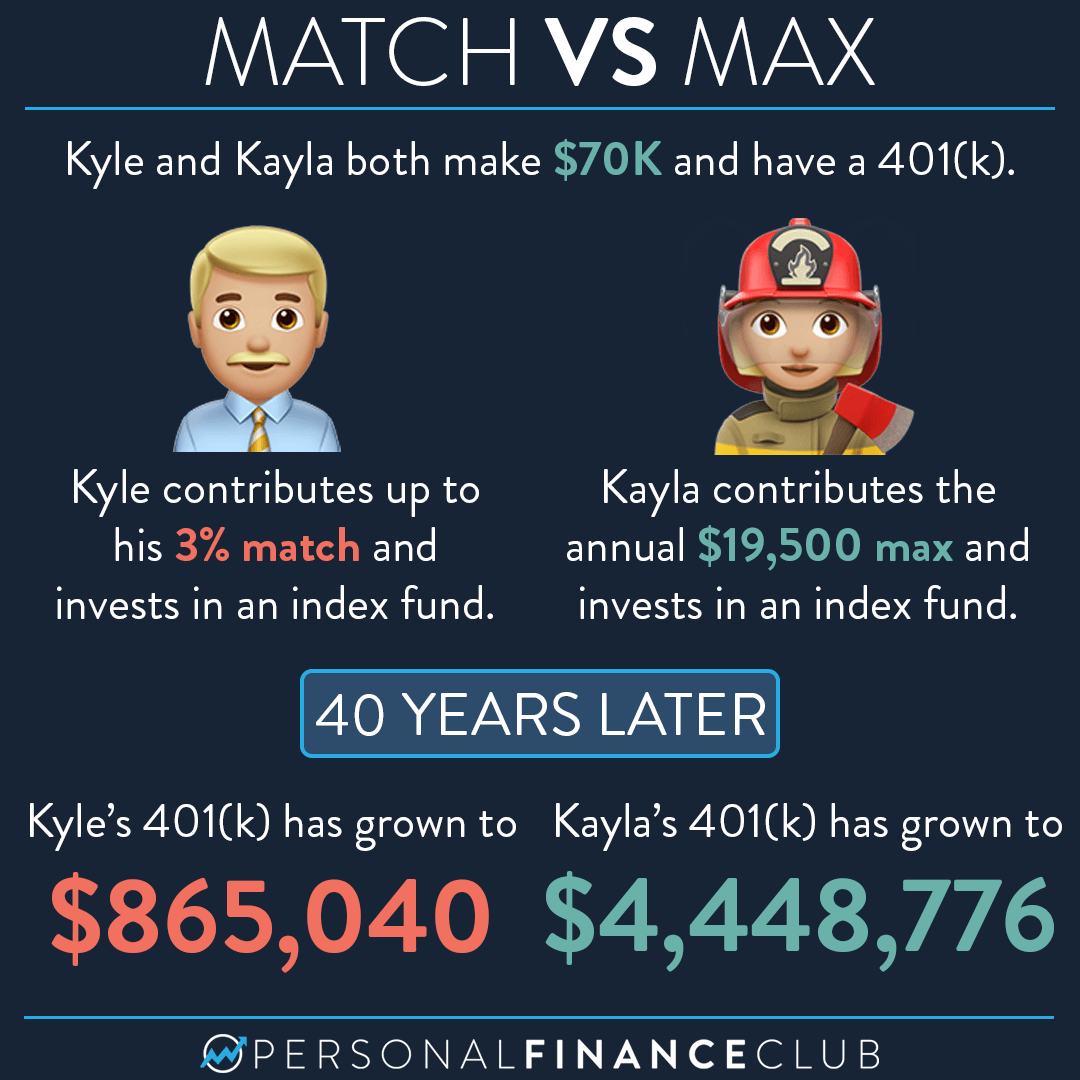

The difference between 401k matching vs maxing Personal Finance Club, Therefore, for these individuals in 2025, the individual total deferral amount for these individuals is $30,500 ($23,000 + $7,500). Contribution limits for a roth 401(k) are the same as a traditional 401(k).

What Is A 401(k) Match? — OnPlane Financial Advisors, These limits increase to $69,000 and $76,500, respectively, in 2025. The contribution limit on 401(k) plans in 2025 is $23,000, with workers 50 and older allowed to set aside an additional $7,500 to catch up on retirement planning.

2025 401k Contribution Limits 'Unprecedented' Increase Projected, But if you max out your 401 (k). Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50.

The contribution limits for a 401 (k) surpass those of traditional and roth individual retirement accounts (iras), and in 2025, you'll have a.

The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government’s thrift savings plan is $23,000 for.