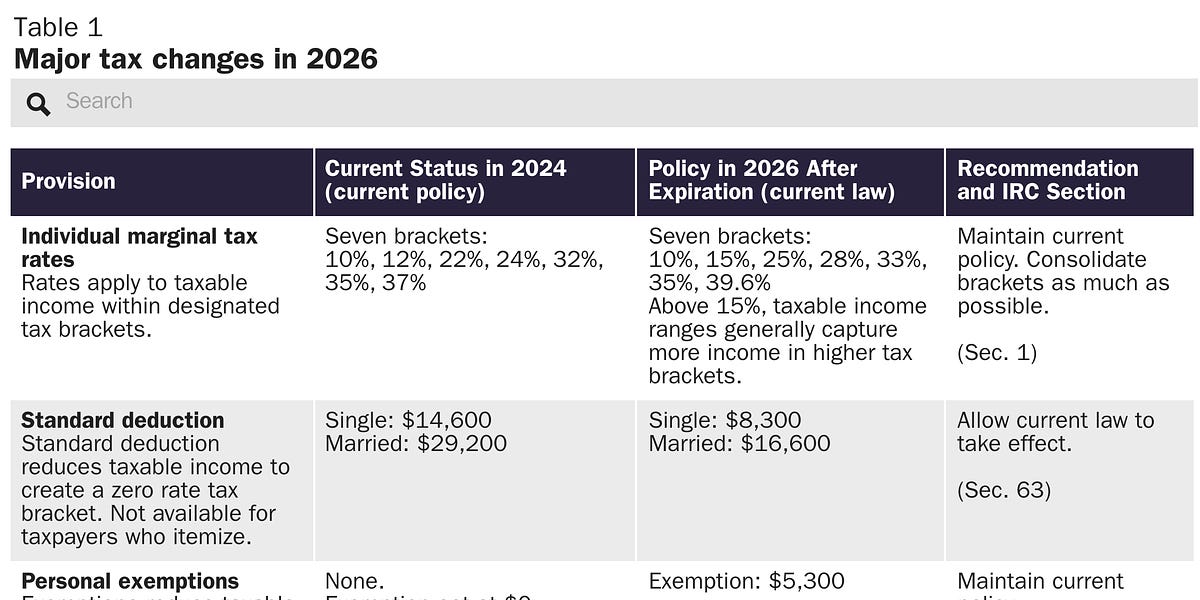

Tax Plan 2026. In the case of the 2026 tax. With the expiration of the tax cuts and jobs act (tcja) set for the end of 2025, significant changes to the tax landscape and 2026 tax brackets could be on the horizon.

2026 Tax Brackets Why Your Taxes Are Likely to Increase in 2026 and, When tcja expires in 2026, the top tax rate would be 39.6%.

Will Tax Rates Sunset In 2026? How to Plan Ahead YouTube, What you can do now to avoid paying higher taxes in 2026.

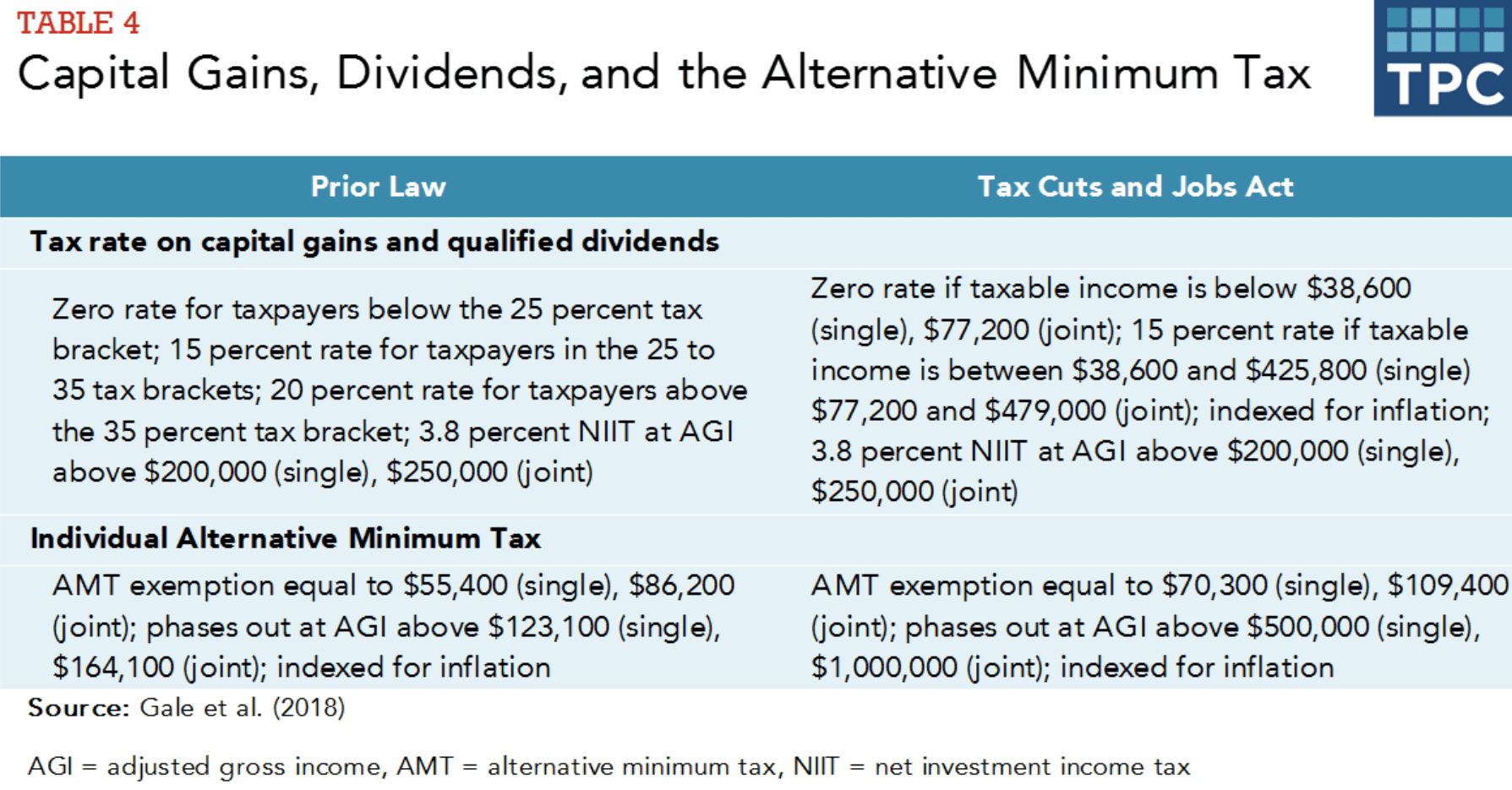

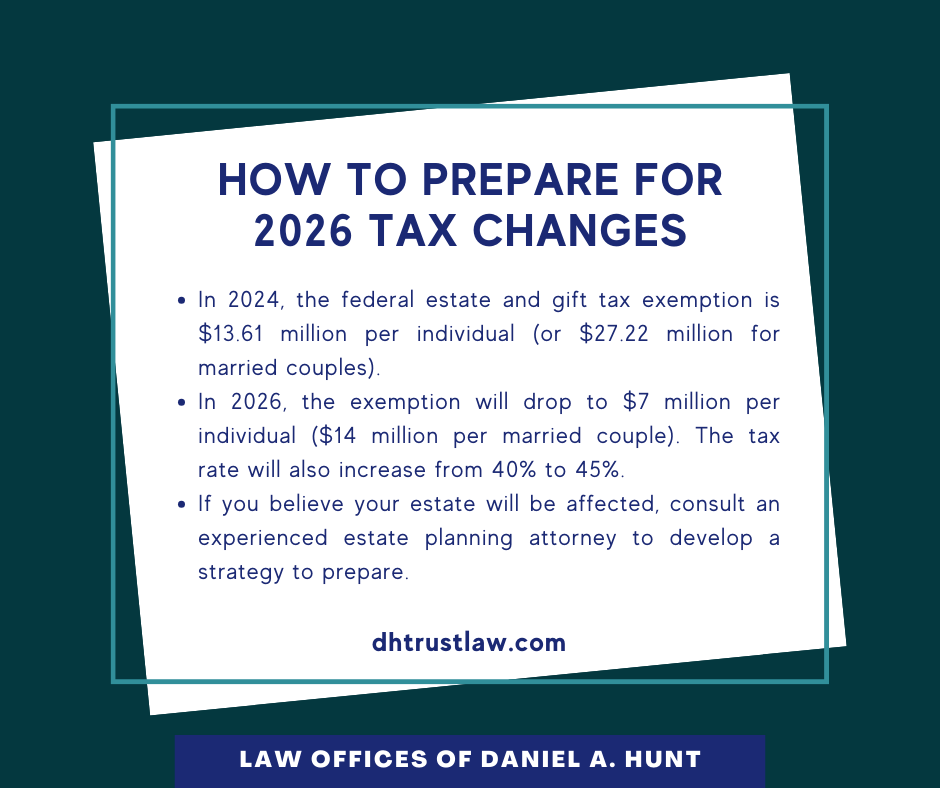

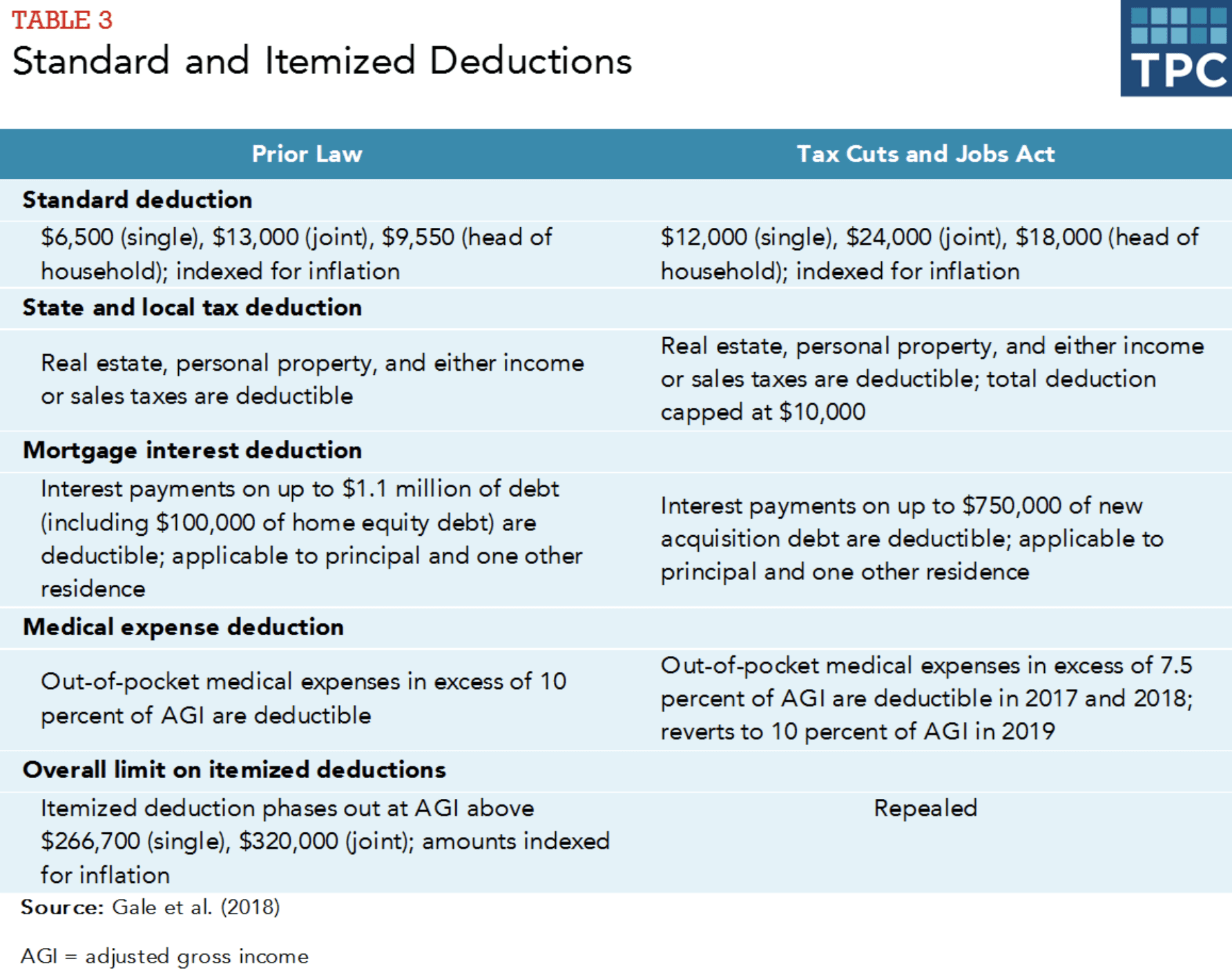

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, There are quite a few changes that could happen to the tax code if nothing is done about the expiring tax cuts and jobs act provisions.

T220048 Baseline Distribution of and Federal Taxes, All Tax, And, for many people, their tax burden will rise.

2026 Tax Increases in One Chart by Adam Michel, When tcja expires in 2026, the top tax rate would be 39.6%.

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, The term tax sunset refers to a provision in the tax code that sets an expiration date for certain tax cuts or changes.

T180088 Average Effective Federal Tax Rates All Tax Units, By, What you can do now to avoid paying higher taxes in 2026.

Tax Rates Sunset in 2026 and Why That Matters Modern Wealth Management, If congress allows the tax cuts and jobs act (tcja) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax.

5 Things To Know About Trump’s Tax Plan, If you fail to familiarize yourself with the implications of expiring tax cuts, you could be in for a big shock during the 2026 tax year.

2026 Tax Law Changes Prepare for TCJA Provisions to Sunset PNC Insights, This isn’t a proposal but a law already set in motion.